Explore our NEW Knowledge Base and Help Desk to find everything you need to attract, engage and convert talent with your Vennture website.

Discover More

Every now and again new features pop up on Google Analytics and the Customer Lifetime Value metric is the latest beta to catch our eye. New additions to the dashboard aren’t just released overnight and we understand that this could be another important metric for your business to track.

“Customer Lifetime Value is the expected monetary amount that each customer will bring to your business over their lifetime”

The metric shows you just how important customer loyalty is and tries to cover the bases regardless of your business model. For example, if you rely on the sale of contracts, it considers the total value of the client instead of just a monthly value.

Revenue earned - cost to acquire = LTV

You don’t always have to deduct the cost of acquisition, but it can provide a realistic look at the profitability of those customers. There are also many other factors that account for this, including resource, time and materials. Therefore, this is the most basic formula.

Currently, it is probably a manual process as your data is likely to be split over multiple systems. If you have a CRM that logs everything accurately, then you might be able to find the acquisition & sales data you need. If you don’t, then your finance department is probably the best place to start.

You need to dig deep to get the most out of your data, by only looking at top level details such as the volume of customers and average order value, you’re hiding what the ‘better than average’ customer looks like versus the ‘worse than average’.

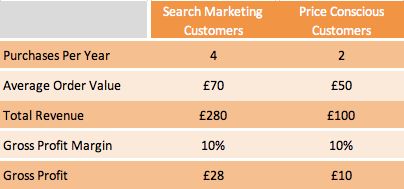

If we break it down by per channel, we can begin to see who the most loyal or profitable customers are. From the example below, we can see that customers who came in via search made more purchases with a higher order value. In response to this, we can look at boosting the SEO strategy to acquire more of those customers.

In relation to recruitment, if clients or candidates are being brought in via your website rather than a job board, then the strength of the leads and their retention rate should be analysed.

Unfortunately, there is no one tool that pulls in all this data, analytics monitors website traffic but then once a lead comes in it can get lost in a CRM if it isn’t tagged appropriately. We should use technology to support best practise behaviours, and previously lead quality and origin hasn’t been tracked particularly well especially when it comes to acquisition online and offline.

If you are always looking at cost per acquisition, then it starts to drive the market value up as everyone is paying for the same leads, which might not be of the most value to your business. Instead, take the time to discover what your best customers look like and spend a little bit more to acquire them. In the long run, it will provide a greater return.

We have a case study that shows how we provided an overall return on investment of 1596% and while the initial CPA was high, the lifetime value of each customer easily outweighed the cost.

From a paid media perspective, look at Return on Ad Spend (ROAS) which shows how much a customer spends online for every £1 you invest. For example, if you pay £5 CPA for a £500 bag the ROAS is £100, if you pay £2 CPA for an £80 jacket the ROAS is £40. So, by paying £3 more for a lead, you have generated a significantly bigger sale.

The lifetime value of a customer can be anywhere from 1 to 3 years, or even longer in some cases and this is classed as their life expectancy. For example, a customer purchasing insurance would typically have a life expectancy of 1 year whereas a customer looking to lease a car could have a 3-year life expectancy.

As you build up data over this time you can start to really define who your best and most profitable customers are long-term and look at building a retention strategy. Comparatively to the acquisition costs, businesses may also need to consider retention costs where a customer is reaching the end of their ‘life expectancy’, it could work out cheaper to retain that client via a content and comms strategy than it would be to acquire a new one.

a

Lifetime value allows us to see how valuable different users are on your website and will help identify opportunities for new strategies but also means we can allocate marketing resources to the acquisition of the most profitable users for your business. In Google Analytics, Lifetime value is currently limited to a 90-day period, but as this feature is still in Beta it could extend in the future.

If you need any help with your marketing strategy, contact one of the team today and we would be happy to talk through your options.